- It provides equitable access to high quality primary, secondary and tertiary healthcare services.

- It provides access to a wide range of healthcare services, facilities and providers.

- It helps to control the rising costs of healthcare services.

- It provides a dedicated source of funding for healthcare services and wellness promotion on a sustainable basis; and

- It improves the overall health and wellness of the entire population.

REGISTERING FOR NATIONAL HEALTH INSURANCE – WHAT YOU SHOULD KNOW

- It provides all residents with the ability to pay for healthcare services without financial hardship.

Yes. Private health insurance policies can be used in combination with or as an alternative to NHI, as well as providing coverage for services not offered by NHI.

There are various therapeutic or preventive healthcare practices, such as homeopathy, naturopathy, chiropractic and herbal medicine, which do not follow generally accepted medical methods and may not have a scientific explanation for their effectiveness. These will not be covered under the NHI system. The service being requested must also be clinically proven and not in its trial phase.

In order to maintain affordable coverage, the NHI will establish spending limits for services by applying usual, customary and reasonable rates.

If a private provider charges higher prices, clients are to be notified in advance.

In the same way as local care except there will be a 20 percent co-payment to the providers in the NHI network and a 40 percent co-payment to the providers not in NHI network.

For emergency cases, you should call the telephone number listed at the back of your NHI card for the required information. There will be a 24 hour service to guide overseas emergency care access.

If you require a specific medical service that forms part of the NHI Benefits Package that cannot be provided in the Territory, NHI may cover some of the costs of this care based on its approval process.

Coverage of overseas care and treatment will be guided by a referral system that requires prior approval by NHI appointed medical specialists. In emergencies (e.g., life-threatening cases), this process can be handled very quickly.

If you opt to pay the costs of treatment abroad and then claim reimbursement from the NHI System when you return, you may be eligible for reimbursement up to NHI rates, upon presentation of original receipts, only if the service is not covered by secondary insurance.

All medical facilities in the Virgin Islands (general, vision and dental) are registered with NHI.

There are no deductibles.

Co-payments will be payable at the following rates:

0% at Community Clinics operated by the BVI Health Services Authority;

5% at Peebles Hospital;

10 % to local providers in the NHI Network;

20 % to local providers out of network;

20 % to overseas providers in network; and

40 % to overseas providers out of network

No. Such persons will have to pay out-of-pocket or through private insurance the full cost for services at the point of delivery. Emergency care provided to visiting United Kingdom nationals by the BVIHSA will be governed by the terms of the UK/BVI Reciprocal Healthcare Agreement.

If you (or your dependent spouse) will be living outside of the Territory for at least six months in any calendar year, the Director may exempt you from the requirement to pay NHI contributions. You will not be entitled to receive benefits unless you give the Director at least three months’ notice of your desire to resume your entitlement to benefits, and three months’ contributions is paid on your behalf.

The Government will make contributions on behalf of dependent children, unemployed seniors (not receiving a pension), indigent persons (as certified by the Chief Social Development Officer), and persons in custody of the State legally residing in the Territory.

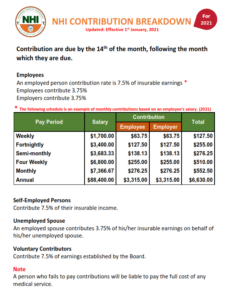

If you have a dependent (unemployed) spouse you will be required to make contributions on your spouse’s behalf at the rate of 3.75 percent of your insurable earnings.

In the case of an unemployed adult who is not self-supporting and has been granted special permission by the Immigration authorities to reside in the Territory, the resident who bears responsibility for that person’s upkeep will be required to make contributions on his or her behalf at the rate of 7.5 percent of the sponsor’s wages or insurable income.

If you have two or more employers, each employer is required to make NHI contributions in the same manner described above. If you have paid contributions on wages that exceed the ‘upper wage limit’ for NHI contributions in any given year, you will be entitled to a refund of the overpayment by making an application to the Director.

If you have two or more employers, each employer is required to make NHI contributions in the same manner described above. If you have paid contributions on wages that exceed the ‘upper wage limit’ for NHI contributions in any given year, you will be entitled to a refund of the overpayment by making an application to the Director.

Yes. The minimum wage in the Territory is presently $6.00 per hour, which equals $1040.00 per month. Employees and employers in this category would each pay $78.00 per month for the employee’s NHI coverage.

The maximum income on which NHI premiums will be assessed is two times the upper wage limit for Social Security contributions; which presently equals $7,500 per month. Therefore the maximum amount payable monthly by employees and employers would be $281.25 each.

Employers are expected to deduct NHI contributions (for each employee and his/her dependent spouse) from their payroll, match it with the employer’s portion, and pay to the NHI Office much the same as they do with Social Security payments.

For persons (of any age) who are employed, NHI premiums will be assessed at 7.5% of insurable earnings, which will be evenly split between the employee and employer (i.e. 3.75% each).

Self-employed persons will pay 7.5% of their insurable earnings.

Unemployed persons with alternative sources of income will contribute at the rate of 7.5% of insurable income.

No. All registered NHI members must be issued NHI cards, which are renewable every five years for children, and every ten years for adults. Cards issued to children under five years old will not feature a photograph.

Each NHI card will be electronically loaded with relevant personal identification and healthcare information, using technology that enables it to store and exchange data securely. Once presented at a health facility, authorized personnel will use, your NHI “smart card” to access specific information over a secure network.

Once registered, a National Health Insurance card with a unique number and photograph will be issued to you. This card must be presented whenever you seek services from a participating healthcare provider. Each member must have his or her own insurance card in order to access benefits. You should always carry your NHI card with you.

Yes. You will be required to apply for registration by filling out the relevant application form, or by having it completed on your behalf. The application form must then be submitted along with proof of identity and immigration and employment status (e.g. birth certificate, passport, Belonger card, marriage certificate, deed poll, affidavit, driver’s license, work permit) or any other document required by the Director to support the accuracy of the information in the application.

Persons who take up residence would be required to apply for registration within one month of arrival in the Territory.

NHI benefits include:

•Health insurance coverage for all legal residents, including their dependents;

•Access to a wide range of primary, secondary and specialised health services;

•Choice of public or private providers;

•Contributions based on ability to pay rather than health risk; and

•Overseas referrals based on clinical need.

The healthcare services included in the Plan’s ‘Benefits Package’ include –

Preventative care – including counseling, screenings, and vaccines to keep you healthy;

Diagnostic procedures – such as lab and imaging tests;

Outpatient care and care for managing chronic diseases;

In-patient care – including hospital room and board;

Surgery;

Intensive care – treatment and monitoring of patients who are critically ill;

Casualty and emergency care;

Prescription drugs;

Mental health and substance abuse disorder services – including behavioral health treatment, counseling, and psychotherapy;

Dental care;

Eye care;

Approved prosthetic devices, and rehabilitation services such as physical and occupational therapy.